Oaktree Capital Management 13F filings

Company

Investment Type

Change

Value (x$1000)

increase or decrease

Chesapeake Energy Corp COM

5,062,363 sh

$558,682

TORM PLC SHS CL A

26,425,059 sh

-14,156,061 sh

-35%

-35%

$527,288

-$307,293

Anglogold Ashanti Plc Common / Ordinary Stock

3,847,991 sh

-337,270 sh

-8%

-8%

$328,157

$33,808

VANECK VECTORS ETF TRUST SEMICONDUCTOR ET

Put options for 865,000 sh

865,000 sh

NEW

NEW

$311,512

$311,512

GARRETT MOTION INC COM

17,094,816 sh

-14,800,000 sh

-46%

-46%

$297,963

-$136,444

SPDR S&P 500 ETF TR TR UNIT

Put options for 385,000 sh

55,000 sh

17%

17%

$262,539

$42,700

INDIVIOR PLC ORD

7,108,644 sh

-250,676,754 sh

-97%

-97%

$255,059

$244,367

VIPER ENERGY INC CL A

6,285,062 sh

$242,792

Barrick Mining Corp - US Equity Option

2,975,118 sh

-326,968 sh

-10%

-10%

$129,566

$21,357

Talen Energy Corp COM

331,117 sh

266,117 sh

409%

409%

$124,116

$96,466

undefined

8,350,708 sh

1,950,000 sh

30%

30%

$121,586

$6,757

NOKIA CORP SPONSORED ADR

18,752,229 sh

$121,327

Talen Energy Corp COM

Call options for 300,000 sh

300,000 sh

NEW

NEW

$112,452

$112,452

ITAU UNIBANCO HLDG SA SPON ADR REP PFD

13,822,747 sh

1,156,946 sh

9%

9%

$98,971

$6,004

LIBERTY GLOBAL LTD COM CL A Stock

8,551,191 sh

$95,260

CBL & ASSOC PPTYS INC COMMON STOCK

2,517,576 sh

-487,550 sh

-16%

-16%

$93,150

$1,253

RIOT PLATFORMS INC NOTE 0.750\% 1/1

$81,960,000 in bonds

$81,960,000 in bonds

$92,922

$92,922

JETBLUE AIRWAYS CORP NOTE 0.500\% 4/0

$90,530,000 in bonds

$22,267,000 in bonds

$89,036

$22,392

GRUPO AEROMEXICO SAB DE CV SPONSORED ADS

3,776,986 sh

3,776,986 sh

NEW

NEW

$82,943

$82,943

TRANSALTA CORP COM

6,415,253 sh

$81,247

SUNOPTA INC COM

20,726,126 sh

$78,883

NU HOLDINGS CL A ORD COM

4,479,175 sh

-39,709 sh

-1%

-1%

$74,981

$2,634

CEMEX SAB DE CV SPON ADR NEW

5,749,324 sh

-4,699,500 sh

-45%

-45%

$66,060

-$27,875

RUNWAY GROWTH FINANCE CORP COM

7,029,667 sh

-1,250,000 sh

-15%

-15%

$62,775

-$21,346

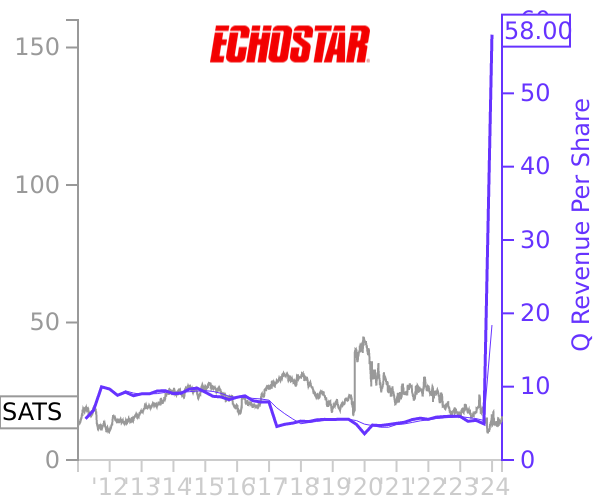

ECHOSTAR CORP NOTE 3.875\%11/3

$18,000,000 in bonds

$18,000,000 in bonds

$60,165

$60,165

CABLE ONE INC CONVERTIBLE BOND

$58,874,000 in bonds

$128,000 in bonds

$58,138

$772

BAUSCH LOMB CORP COM

3,382,739 sh

137,300 sh

4%

4%

$57,777

$8,868

GRAB HOLDINGS LIMITED CLASS A ORD Stock

11,207,699 sh

-886,796 sh

-7%

-7%

$55,926

-$16,883

XP INC CL A

3,320,159 sh

1,287,282 sh

63%

63%

$54,351

$16,153

AIRBNB INC CONVERTIBLE BOND

$50,633,000 in bonds

$11,280,000 in bonds

$50,228

$11,662

ETSY INC NOTE 0.250\% 6/1

$50,165,000 in bonds

$10,835,000 in bonds

$44,935

$10,098

BIOMARIN PHARMACEUTICAL INC NOTE 1.250\% 5/1

$42,118,000 in bonds

$22,399,000 in bonds

$40,450

$21,707

AMPH US 3/15/2029

$43,578,000 in bonds

$25,753,000 in bonds

$40,401

$24,155

CONMED CORP NOTE 2.250 6/1 BND

$40,324,000 in bonds

-$189,000

0%

0%

$38,711

$61

MARRIOTT VACATIONS WORLDWIDE 3.250\%12/1

$40,370,000 in bonds

$4,538,000 in bonds

$38,452

$4,207

PEBBLEBROOK HOTEL TR NOTE 1.750\%12/1

$39,706,000 in bonds

$13,530,000 in bonds

$38,416

$12,555

VISTA OIL & GAS S A B DE C V SPONSORED ADS

782,250 sh

-1,059,069 sh

-58%

-58%

$38,064

-$25,277

FULL TRUCK ALLIANCE CO LTD SPONSORED ADS

3,519,764 sh

-277,933 sh

-7%

-7%

$37,767

-$11,489

SEA LTD NOTE 0.250\% 9/1

$38,855,000 in bonds

$1,827,000 in bonds

$37,767

$2,213

STAR BULK CARRIERS CORP SHS PAR

1,962,892 sh

$37,727

TELADOC HEALTH INC NOTE 1.250\% 6/0

$38,479,000 in bonds

-$2,159,000

-5%

-5%

$36,747

-$1,412

ENPHASE ENERGY INC CONVERTIBLE BOND

$38,178,000 in bonds

$9,556,000 in bonds

$33,358

$8,497

CRACKER BARREL OLD CTRY STOR NOTE 0.625\% 6/1

$33,101,000 in bonds

$8,328,000 in bonds

$32,192

$8,391

CALIFORNIA RES CORP COMMON STOCK

694,502 sh

$31,051

KANZHUN ADS COM

1,523,231 sh

-120,341 sh

-7%

-7%

$31,043

-$7,351

ARRAY TECHNOLOGIES INC NOTE 1.000\%12/0

$33,284,000 in bonds

$8,595,000 in bonds

$30,263

$8,795

ENVISTA HOLDINGS CORPORATION NOTE 1.750\% 8/1

$30,786,000 in bonds

$5,307,000 in bonds

$29,632

$5,538

undefined

Call options for 2,000,000 sh

2,000,000 sh

NEW

NEW

$29,120

$29,120

OKTA INC NOTE 0.375\% 6/

$28,311,000 in bonds

$11,405,000 in bonds

$27,773

$11,282

FIVE9 INC NOTE 1.000\% 3/1

$30,353,000 in bonds

$22,570,000 in bonds

$27,394

$20,479

ALARM.COM HOLDINGS INC CONVERTIBLE BOND

$27,198,000 in bonds

$2,441,000 in bonds

$27,266

$2,781

TELECOM ARGENTINA S A SPON ADR REP B

2,347,508 sh

-281,975 sh

-11%

-11%

$27,255

$8,139

VALE S A SPONSORED ADS

2,023,706 sh

-10,000 sh

0%

0%

$26,369

$4,283

SPECTRUM BRANDS INC NOTE 3.375\% 6/0

$27,496,000 in bonds

$11,275,000 in bonds

$26,073

$10,959

DEXCOM INC NOTE 0.375 5/1 BND

$27,995,000 in bonds

$27,995,000 in bonds

$25,776

$25,776

TERNIUM SA SPONSORED ADS

658,565 sh

-238,944 sh

-27%

-27%

$25,151

-$6,019

RICE ACQUISITION CORP 3 ORD SHS CL A

2,400,000 sh

2,400,000 sh

NEW

NEW

$24,660

$24,660

Oaktree Specialty Lending Corp COM

1,852,456 sh

$23,600

DRAFTKINGS INC NOTE

$25,225,000 in bonds

$25,225,000 in bonds

$23,091

$23,091

MGP INGREDIENTS INC NEW OTE 1.875\%11/1

$23,225,000 in bonds

$5,950,000 in bonds

$22,528

$5,973

SUMMIT HOTEL PROPERTIES NOTE 1.500\% 2/1

$21,560,000 in bonds

-$7,881,000

-27%

-27%

$21,495

-$7,490

BLOCK INC Sovereign/Corporate

$20,243,000 in bonds

$10,229,000 in bonds

$19,940

$10,179

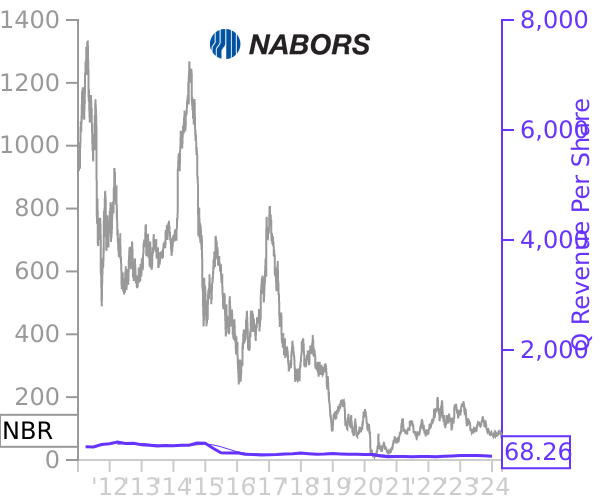

NABORS INDS INC NOTE 1.750\% 6/

$24,063,000 in bonds

$11,230,000 in bonds

$19,604

$9,723

INFOSYS LTD SPONSORED ADR

1,094,752 sh

1,094,752 sh

NEW

NEW

$19,508

$19,508

JD.com 0.250 01-Jun-2029 GLOBAL

$19,233,000 in bonds

-$4,588,000

-19%

-19%

$19,320

-$6,335

CERIDIAN HCM HLDG INC NOTE 0.25

$19,351,000 in bonds

$9,969,000 in bonds

$19,206

$10,014

WINNEBAGO INDS INC NOTE 3.250\% 1/1

$20,220,000 in bonds

$15,312,000 in bonds

$19,057

$14,650

SNAP INC NOTE 5/0 ADDED

$19,576,000 in bonds

$6,599,000 in bonds

$18,255

$6,251

SYNAPTICS INC NOTE 0.750\%12/0

$17,250,000 in bonds

$17,250,000 in bonds

$18,251

$18,251

OCWEN FINL CORP COM

390,835 sh

390,835 sh

NEW

NEW

$17,896

$17,896

LIVN US 3/15/2029

$15,285,000 in bonds

$200,000 in bonds

$17,731

$1,478

PPL CAP FDG INC NOTE 2.875\% 3/1

$15,672,000 in bonds

-$61,000

0%

0%

$17,220

-$759

AEROVIRONMENT INC NOTE 7/1

$15,763,000 in bonds

-$2,000,000

-11%

-11%

$17,142

-$4,911

TETRA TECH INC NEW DBCV 2.250\% 8/1

$15,289,000 in bonds

$3,384,000 in bonds

$16,626

$3,724

CMS ENERGY CORP NOTE 3.375\% 5/0

$15,199,000 in bonds

-$2,144,000

-12%

-12%

$16,293

-$2,741

HAEMONETICS CORP CONVERTIBLE BOND

$15,030,000 in bonds

$5,784,000 in bonds

$14,917

$5,833

JAZZ INVESTMENTS I LTD NOTE 3.125\% 9/1

$10,600,000 in bonds

-$6,100,000

-37%

-37%

$14,135

-$5,721

WEC ENERGY GROUP INC NOTE 4.375\% 6/0

$11,957,000 in bonds

-$457,000

-4%

-4%

$13,978

-$1,279

LANTHEUS HLDGS INC NOTE 2.62512/1 BND

$11,525,000 in bonds

$5,250,000 in bonds

$13,234

$6,619

SNAP INC NOTE 0.125\% 3/0

$13,422,000 in bonds

-$1,917,000

-12%

-12%

$12,184

-$1,514

BANDWIDTH INC NOTE 0.500\% 4/0

$13,650,000 in bonds

$5,020,000 in bonds

$11,923

$4,553

BLACKSTONE MORTGAGE TRUST IN NOTE 5.500\% 3/1

$11,999,000 in bonds

$5,060,000 in bonds

$11,885

$5,050

REDFIN CORP NOTE 0.500\% 4/0

$11,841,000 in bonds

$3,721,000 in bonds

$11,142

$3,603

PENNYMAC CORP BOND

$10,935,000 in bonds

$5,524,000 in bonds

$10,951

$5,551

ENPHASE ENERGY INC NOTE 3/0

$10,911,000 in bonds

-$2,149,000

-16%

-16%

$10,802

-$1,965

COINBASE GLOBAL INC NOTE 0.250\% 4/0

$10,510,000 in bonds

-$2,500,000

-19%

-19%

$10,791

-$5,592

REPLIGEN CORP NOTE 1.000\%12/1

$9,830,000 in bonds

$1,008,000 in bonds

$10,788

$1,895

FLUOR CORP NOTE 1.125\% 8/1

$9,371,000 in bonds

-$1,100,000

-11%

-11%

$10,699

-$1,751

MAGNITE INC CONVERTIBLE BOND

$10,305,000 in bonds

$3,668,000 in bonds

$10,222

$3,736

LIVE NATION ENTERTAINMENT IN NOTE 2.875\% 1/1

$9,670,000 in bonds

$9,670,000 in bonds

$10,183

$10,183

ZIFF DAVIS INC NOTE

$10,091,000 in bonds

$3,715,000 in bonds

$9,889

$3,757

LCI INDS NOTE 1.125\% 5/1

$9,927,000 in bonds

$3,521,000 in bonds

$9,798

$3,639

CALLAWAY GOLF CO NOTE 2.750\% 5/0

$9,596,000 in bonds

$5,150,000 in bonds

$9,584

$5,189

CHESAPEAKE ENERGY CORP *W EXP 03/01/202

95,294 sh

$9,496

COGT US 11/15/2031

$7,650,000 in bonds

$7,650,000 in bonds

$8,995

$8,995

BAUSCH HEALTH COS INC COM

1,270,000 sh

$8,827

ITRON INC NOTE 1.375\% 7/1

$8,700,000 in bonds

$8,700,000 in bonds

$8,814

$8,814

UNITY SOFTWARE INC NOTE 11/1

$9,076,000 in bonds

$5,325,000 in bonds

$8,792

$5,211

FRESHPET INC BOND

$7,300,000 in bonds

$3,000,000 in bonds

$8,552

$3,708

MKS INC. NOTE 1.250\% 6/0

$6,255,000 in bonds

-$10,450,000

-63%

-63%

$7,994

-$10,340

DATADOG INC NOTE 12/0

$7,499,000 in bonds

$7,499,000 in bonds

$7,508

$7,508

REDWOOD TRUST INC BOND

$7,456,000 in bonds

$1,873,000 in bonds

$7,437

$1,837

GPRE 2.25\% 03/15/2027

$7,677,000 in bonds

$7,677,000 in bonds

$7,389

$7,389

MAGNACHIP SEMICONDUCTOR CORP COM

2,849,858 sh

$7,267

UPSTART HLDGS INC NOTE 0.250\% 8/1

$7,199,000 in bonds

-$4,244,000

-37%

-37%

$6,965

-$3,934

UPWORK INC NOTE 0.250\% 8/1

$7,038,000 in bonds

$2,392,000 in bonds

$6,885

$2,375

BENTLEY SYS INC NOTE 0.375\% 7/0

$6,730,000 in bonds

$4,844,000 in bonds

$6,346

$4,566

NEOGENOMICS INC NOTE 0.250\% 1/1

$7,098,000 in bonds

$3,168,000 in bonds

$6,344

$2,945

VERTEX INC NOTE 0.750\% 5/0

$6,507,000 in bonds

-$743,000

-10%

-10%

$6,181

-$1,214

CERENCE INC BOND

$6,605,000 in bonds

$2,544,000 in bonds

$5,964

$2,577

BLOCK INC NOTE 0.250\%11/0

$5,935,000 in bonds

$2,564,000 in bonds

$5,509

$2,430

SHAKE SHACK INC NOTE

$5,686,000 in bonds

-$6,030,000

-51%

-51%

$5,387

-$5,765

MITEK SYS INC NOTE 0.750\% 2/0

$5,374,000 in bonds

$5,374,000 in bonds

$5,326

$5,326

NUTANIX INC NOTE 0.500\%12/1

$5,436,000 in bonds

$5,436,000 in bonds

$5,257

$5,257

AFFIRM HLDGS INC NOTE 11/1

$5,225,000 in bonds

$934,000 in bonds

$5,042

$943

PENN NATL GAMING INC NOTE2.750\% 5/1

$4,952,000 in bonds

$4,952,000 in bonds

$4,911

$4,911

SOUTHERN CO NOTE 4.500\% 6/1

$4,557,000 in bonds

$4,874

HDFC BANK LTD SPONSORED ADS

130,441 sh

-20,765 sh

-14%

-14%

$4,766

-$399

STRATEGY INC CV

$5,763,000 in bonds

$5,763,000 in bonds

$4,746

$4,746

SNAP INC NOTE 0.750\% 8/0

$3,767,000 in bonds

$1,704,000 in bonds

$3,652

$1,676

ZIFF DAVIS INC DEBT 3.625\% 3/0

$3,496,000 in bonds

$2,145,000 in bonds

$3,429

$2,122

AMERICAN WTR CAP CORP NOTE 3.625\% 6/1

$3,426,000 in bonds

$3,426,000 in bonds

$3,416

$3,416

BATTALION OIL CORP COMMON

3,009,912 sh

-3,911 sh

0%

0%

$3,401

-$246

TWO HBRS INVT CORP NOTE 6.250\% 1/1

$3,298,000 in bonds

-$426,000

-11%

-11%

$3,290

-$434

Bill.com Holdings CONV BOND

$3,306,000 in bonds

-$51,000

-2%

-2%

$3,137

$4

ALVOTECH SA ALVOTECH SA 27

4,666,667 sh

$3,033

FORD MOTOR CO CONVERTIBLE BOND

$2,900,000 in bonds

$2,900,000 in bonds

$3,019

$3,019

BRIDGEBIO PHARMA INC NOTE 2.25

$2,550,000 in bonds

-$8,207,000

-76%

-76%

$2,872

-$7,759

POST HLDGS INC 2.5 08/15/2027 Convertible

$2,650,000 in bonds

$1,350,000 in bonds

$2,858

$1,396

ON SEMICONDUCTOR CORP NOTE 5/0

$1,950,000 in bonds

$2,326

NUTANIX INC NOTE 0.250\%10/0

$2,000,000 in bonds

$2,000,000 in bonds

$2,251

$2,251

WISDOMTREE INC NOTE 3.250\% 8/1

$1,850,000 in bonds

$1,850,000 in bonds

$2,228

$2,228

DROPBOX INC CONVERTIBLE BOND

$2,175,000 in bonds

$2,175,000 in bonds

$2,160

$2,160

ALVOTECH ORDINARY SHARES

533,656 sh

-1,030,020 sh

-66%

-66%

$2,023

-$10,784

CHEESECAKE FACTORY NOTE 0.375\% 6/1

$1,960,000 in bonds

$1,960,000 in bonds

$1,942

$1,942

GROUPON INC NOTE 1.125\% 3/1

$1,874,000 in bonds

-$508,000

-21%

-21%

$1,863

-$436

VAIL RESORTS INC NOTE 1/0

$1,819,000 in bonds

-$4,271,000

-70%

-70%

$1,820

-$4,200

DIGITALOCEAN HLDGS INC NOTE 12/0

$1,880,000 in bonds

-$151,000

-7%

-7%

$1,817

-$101

BLACKLINE INC NOTE

$1,816,000 in bonds

$1,816,000 in bonds

$1,801

$1,801

NEXTERA ENERGY CAP HLDGS INC NOTE 3.000\% 3/0

$1,292,000 in bonds

-$6,276,000

-83%

-83%

$1,607

-$7,350

CELCUITY INC NOTE 2.750\% 8/0

$700,000 in bonds

$700,000 in bonds

$1,520

$1,520

FASTLY INC NOTE 7.750\% 6/0

$1,353,000 in bonds

$1,353,000 in bonds

$1,497

$1,497

VISHAY INTERTECHNOLOGY INC NOTE 2.250\% 9/1

$1,651,000 in bonds

$1,651,000 in bonds

$1,488

$1,488

SPOTIFY TECHNOLOGY SA CONVERTIBLE BOND

$1,300,000 in bonds

$1,300,000 in bonds

$1,479

$1,479

TRIP COM GROUP LTD NOTE 0.750\% 6/1

$1,189,000 in bonds

-$3,035,000

-72%

-72%

$1,468

-$3,937

HERBALIFE LTD NOTE 4.250\% 6/1

$1,242,000 in bonds

-$1,605,000

-56%

-56%

$1,347

-$1,306

MICROSTRATEGY INC NOTE 0.875\% 3/1

$1,300,000 in bonds

$1,300,000 in bonds

$1,342

$1,342

LYFT INC NOTE 0.625\% 3/0

$1,100,000 in bonds

$1,326

Parsons Corp 2.625 01-Mar-2029 US DOMESTIC

$1,160,000 in bonds

-$11,750,000

-91%

-91%

$1,195

-$13,555

AFFIRM HLDGS INC NOTE 0.750\%12/1

$927,000 in bonds

$927,000 in bonds

$1,029

$1,029

TYLER TECHNOLOGIES INC CONVERTIBLE BOND

$1,000,000 in bonds

$1,000,000 in bonds

$1,014

$1,014

ASCENDIS PHARMA A/S NOTE 2.250\% 4/0

$700,000 in bonds

-$300,000

-30%

-30%

$994

-$370

RINGCENTRAL INC NOTE 3/1 ADDED

$984,000 in bonds

$984,000 in bonds

$975

$975

HAEMONETICS CORP MASS NOTE 2.500\% 6/0

$902,000 in bonds

$902,000 in bonds

$939

$939

FASTLY INC CONVERTIBLE BOND

$863,000 in bonds

-$491,000

-36%

-36%

$850

-$448

GLADSTONE CAP CORP NOTE 5.875\%10/0

$754,000 in bonds

$754,000 in bonds

$739

$739

GUARDANT HEALTH INC Sovereign/Corporate

$555,000 in bonds

-$4,092,000

-88%

-88%

$600

-$3,875

PELOTON INTERACTIVE INC CONVERTIBLE BOND

$559,000 in bonds

-$795,000

-59%

-59%

$553

-$779

BIOXCEL THERAPEUTICS INC COM NEW Stock

241,188 sh

$386

RICE ACQUISITION CORP 3 *W EXP 99/99/999

399,999 sh

399,999 sh

NEW

NEW

$320

$320

ISHARES TR RUSSELL 2000 ETF

Put options for 0 sh

-220,000 sh

-100%

-100%

$0

-$53,231

SAREPTA THERAPEUTICS INC NOTE 1.250 9/1 BND

$0 in bonds

-$34,930,000

-100%

-100%

$0

-$30,815

SEA LTD SPONSORED ADS

0 sh

-141,368 sh

-100%

-100%

$0

-$25,267

JBS NV Class A Com

0 sh

-1,580,400 sh

-100%

-100%

$0

-$23,595

FIRST MAJESTIC SILVER CORP NOTE 0.375\% 1/1

$0 in bonds

-$18,133,000

-100%

-100%

$0

-$19,680

SHIFT4 PAYMENTS NOTE 0.500\% 8/0

$0 in bonds

-$14,544,000

-100%

-100%

$0

-$14,349

MERITAGE HOMES CORP NOTE 1.750\% 5/1

$0 in bonds

-$12,695,000

-100%

-100%

$0

-$13,056

DEXCOM INC NOTE 0.250\%11/

$0 in bonds

-$12,963,000

-100%

-100%

$0

-$12,875

GUARDANT HEALTH INC DEBT 1.250\% 2/1

$0 in bonds

-$9,240,000

-100%

-100%

$0

-$12,054

TRAVERE THERAPEUTICS INC NOTE

$0 in bonds

-$9,213,000

-100%

-100%

$0

-$10,433

BLACKLINE INC NOTE 1.000\% 6/0

$0 in bonds

-$8,148,000

-100%

-100%

$0

-$8,481

LI AUTO INC NOTE 0.250\% 5/0

$0 in bonds

-$7,279,000

-100%

-100%

$0

-$8,322

LEGENCE CORP CL A

0 sh

-175,000 sh

-100%

-100%

$0

-$5,392

VERINT SYSTEMS INC NOTE 0.250\% 4/1

$0 in bonds

-$4,626,000

-100%

-100%

$0

-$4,539

FUBOTV INC NOTE 3.250 2/1 BND

$0 in bonds

-$4,538,000

-100%

-100%

$0

-$4,493

NOVOCURE LIMITED Sovereign/Corporate

$0 in bonds

-$4,337,000

-100%

-100%

$0

-$4,310

GUESS INC NOTE 3.750\% 4/1

$0 in bonds

-$3,621,000

-100%

-100%

$0

-$3,595

Q2 HLDGS INC NOTE 0.125\%11/1

$0 in bonds

-$2,701,000

-100%

-100%

$0

-$2,678

BRIDGEBIO PHARMA INC NOTE 2.500\% 3/1

$0 in bonds

-$1,850,000

-100%

-100%

$0

-$2,601

UBER TECHNOLOGIES INC NOTE 0.875\%12/0

$0 in bonds

-$1,503,000

-100%

-100%

$0

-$2,213

ESPERION THERAPEUTICS INC NE NOTE 4.000\%11/1

$0 in bonds

-$2,114,000

-100%

-100%

$0

-$2,110

WAYFAIR INC NOTE 3.250 9/1 BND

$0 in bonds

-$900,000

-100%

-100%

$0

-$1,374

IRHYTHM TECHNOLOGIES INC NOTE 1.500\% 9/0

$0 in bonds

-$900,000

-100%

-100%

$0

-$1,239

TRANSPORTADORA DE GAS SUR SPONSORED ADS B

0 sh

-56,522 sh

-100%

-100%

$0

-$1,189

FIVERR INTL LTD NOTE 11/0

$0 in bonds

-$1,049,000

-100%

-100%

$0

-$1,049

EVOLENT HEALTH INC NOTE 3.500\%12/0

$0 in bonds

-$1,015,000

-100%

-100%

$0

-$818

TPI Composites Inc. COM

0 sh

-4,610,003 sh

-100%

-100%

$0

-$143