GMO Grantham, Mayo, Van Otterloo 13F filings

Company

Investment Type

Change

Value (x$1000)

increase or decrease

Lam Research COM

9,344,080 sh

-489,931 sh

-5%

-5%

$1,599,520

$282,746

US BANCORP DEL COM NEW

18,401,004 sh

642,057 sh

4%

4%

$981,878

$123,588

WELLS FARGO CO NEW COM

5,347,858 sh

-939,377 sh

-15%

-15%

$498,421

-$28,575

TORONTO DOMINION BK ONT COM NEW

1,845,845 sh

312,274 sh

20%

20%

$174,192

$51,542

GSK PLC SPONSORED ADR ADR

3,489,374 sh

917,248 sh

36%

36%

$171,119

$60,106

DEUTSCHE BANK AG NAMEN AKT

3,822,714 sh

-393,448 sh

-9%

-9%

$148,650

$278

ASML HOLDING N V N Y REGISTRY SHS

130,493 sh

105,867 sh

430%

430%

$139,610

$115,769

Vodafone Group PLC ADR COM

10,374,561 sh

-209,117 sh

-2%

-2%

$137,048

$14,277

RIO TINTO PLC SPONSORED ADR

1,568,244 sh

441,799 sh

39%

39%

$125,507

$51,150

TAIWAN SEMICONDUCTOR MFG LTD SPONSORED ADS

407,315 sh

240,087 sh

144%

144%

$123,779

$77,074

SOCIEDAD QUIMICA MINERA DE C SPON ADR SER B

1,712,940 sh

-233,324 sh

-12%

-12%

$117,850

$34,200

TOTAL-PARIS COM

1,550,700 sh

1,550,700 sh

NEW

NEW

$101,259

$101,259

BRITISH AMERN TOB PLC SPONSORED ADR

1,521,732 sh

-162,193 sh

-10%

-10%

$86,160

-$3,223

ARRAY TECHNOLOGIES INC COM SHS

8,279,542 sh

-593,530 sh

-7%

-7%

$76,337

$4,021

NEXGEN ENERGY LTD COM

7,765,886 sh

-1,044,168 sh

-12%

-12%

$71,554

-$7,340

BANK AMER CORP COM

1,110,699 sh

62,199 sh

6%

6%

$61,088

$6,996

BANK N S HALIFAX COM

825,124 sh

72,610 sh

10%

10%

$60,881

$12,220

MAGNA INTL INC COM

1,117,408 sh

293,083 sh

36%

36%

$59,568

$20,510

Capital One Financial COM

216,404 sh

27,452 sh

15%

15%

$52,448

$12,281

Fiat Chrysler Automobiles N.V. COM

4,704,485 sh

-6,236 sh

0%

0%

$52,274

$8,746

MANULIFE FINL CORP COM

1,394,526 sh

-872,175 sh

-38%

-38%

$50,645

-$19,978

OPEN TEXT CORP COM

1,409,250 sh

32,349 sh

2%

2%

$45,920

-$5,550

Synchrony Financial cs

539,145 sh

47,735 sh

10%

10%

$44,981

$10,066

CALIFORNIA RES CORP COMMON STOCK

994,879 sh

-120,500 sh

-11%

-11%

$44,481

-$14,835

PNM RESOURCES INC COM

745,857 sh

69,763 sh

10%

10%

$43,916

$5,683

Barrick Mining Corp - US Equity Option

986,183 sh

604,333 sh

158%

158%

$42,965

$30,452

VISTA OIL & GAS S A B DE C V SPONSORED ADS

869,908 sh

-113,000 sh

-11%

-11%

$42,330

$8,518

YPF SOCIEDAD ANONIMA SPON ADR CL D

1,145,878 sh

-229,700 sh

-17%

-17%

$41,435

$8,022

NOVARTIS A G SPONSORED ADR

299,175 sh

-31,857 sh

-10%

-10%

$41,247

-$1,205

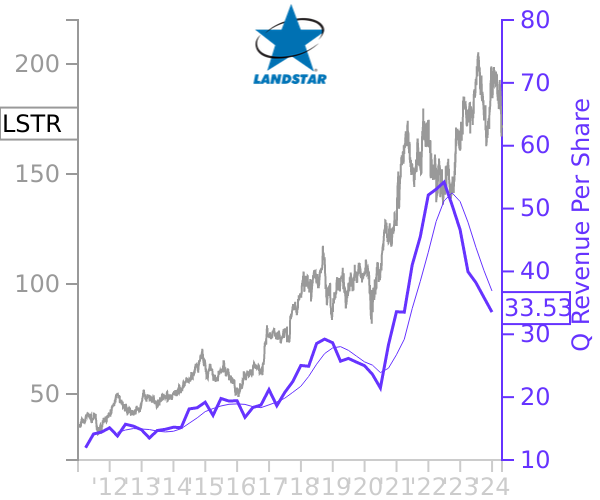

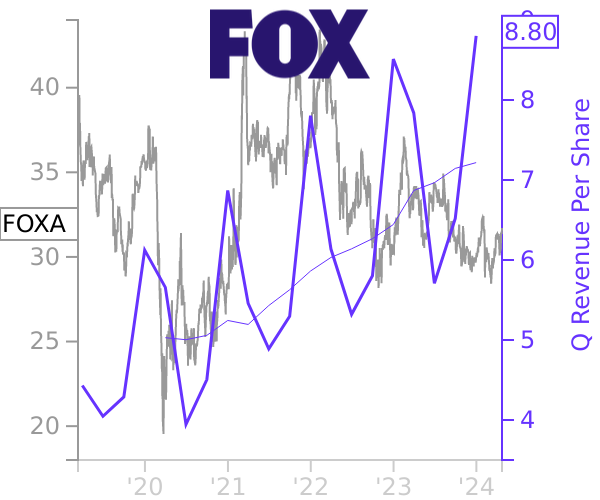

FOX CORP CL B COM

568,440 sh

-216,576 sh

-28%

-28%

$36,909

-$8,065

COMERICA INC COM

423,815 sh

423,815 sh

NEW

NEW

$36,842

$36,842

THE MAGNUM ICE CREAM COMPANYN.V. ORDINARY CONSUMER STAPLES

2,219,681 sh

2,219,681 sh

NEW

NEW

$35,161

$35,161

CEMEX SAB DE CV SPON ADR NEW

3,056,131 sh

1,902,549 sh

165%

165%

$35,115

$24,744

VIPSHOP HLDGS LTD SPONSORED ADS A

1,890,621 sh

546,700 sh

41%

41%

$33,445

$7,050

SUN LIFE FINL INC COM

529,521 sh

84,069 sh

19%

19%

$33,079

$6,330

CGI INC CL A SUB VTG

357,455 sh

199,100 sh

126%

126%

$33,061

$18,953

NORTHWESTERN CORP COM NEW

483,291 sh

424,593 sh

723%

723%

$31,192

$27,752

UNILEVER PLC SPON ADR NEW

469,364 sh

469,364 sh

NEW

NEW

$30,696

$30,696

KENVUE INC COM

1,658,034 sh

1,508,024 sh

1005%

1005%

$28,601

$26,166

GE HEALTHCARE TECHNOLOGIES I COMMON STOCK

339,714 sh

31,681 sh

10%

10%

$27,863

$4,730

BANCO BRADESCO S A SP ADR PFD NEW

8,034,400 sh

4,268,800 sh

113%

113%

$26,755

$14,027

STMICROELECTRONICS N V NY REGISTRY

1,019,708 sh

173,249 sh

20%

20%

$26,451

$2,530

GMO ETF TRUST GMO DOMESTIC RES

1,021,869 sh

1,021,869 sh

NEW

NEW

$26,128

$26,128

STATE STR CORP COM

201,640 sh

-18,458 sh

-8%

-8%

$26,014

$480

ISHARES INC MSCI JPN ETF NEW

311,177 sh

$25,124

CYBERARK SOFTWARE LTD SHS

54,927 sh

2,209 sh

4%

4%

$24,501

-$970

HONDA MOTOR LTD AMERN SHS

788,084 sh

623 sh

0%

0%

$23,233

-$1,021

NICE LTD SPONSORED ADR

198,136 sh

77,679 sh

64%

64%

$22,397

$4,957

CNH INDL N V SHS

2,413,218 sh

902,370 sh

60%

60%

$22,250

$5,857

Chesapeake Energy Corp COM

199,000 sh

134,300 sh

208%

208%

$21,962

$15,088

NUTRIEN LTD COM

352,341 sh

-78,553 sh

-18%

-18%

$21,747

-$3,552

NEXTRACKER INC COM CL A

248,612 sh

-190,087 sh

-43%

-43%

$21,657

-$10,802

SOLVENTUM CORP COMMON

270,190 sh

-9,156 sh

-3%

-3%

$21,410

$1,018

LOGITECH INTL S A SHS

182,079 sh

13,338 sh

8%

8%

$18,738

$334

SAP SE SPON ADR

76,449 sh

33,901 sh

80%

80%

$18,570

$7,201

BANK MONTREAL QUE COM

131,825 sh

-32,981 sh

-20%

-20%

$17,142

-$4,338

GULFPORT ENERGY COM

78,439 sh

-17,300 sh

-18%

-18%

$16,315

-$1,012

HALEON PLC SPON ADS COM

1,598,290 sh

709,451 sh

80%

80%

$16,159

$8,186

2023 ETF SERIES TRUST II GMO SYSTEMATIC I

621,143 sh

371,063 sh

148%

148%

$15,942

$9,478

TE CONNECTIVITY LTD SHS Stock

67,755 sh

-368 sh

-1%

-1%

$15,415

$460

GRUPO CIBEST SA SPON ADS

235,217 sh

21,500 sh

10%

10%

$14,962

$3,862

PNC FINL SVCS GROUP INC COM

64,515 sh

-4,298 sh

-6%

-6%

$13,466

-$361

NEW GOLD INC CDA COM

1,531,059 sh

1,531,059 sh

NEW

NEW

$13,336

$13,336

TENARIS S A SPONSORED ADS

332,238 sh

61,358 sh

23%

23%

$12,775

$3,086

NEWS CORP NEW COM

465,404 sh

-5,000 sh

-1%

-1%

$12,156

-$2,290

LIFEZONE METALS LIMITED ORD SHS

2,550,100 sh

$10,889

DIAGEO P L C SPON ADR NEW

111,920 sh

57,570 sh

106%

106%

$9,655

$4,468

NOVO-NORDISK A S ADR

184,971 sh

108,359 sh

141%

141%

$9,411

$5,160

ORMAT TECHNOLOGIES INC COM

84,890 sh

-33,046 sh

-28%

-28%

$9,378

-$1,973

CADENCE BANK COM Stock

213,281 sh

213,281 sh

NEW

NEW

$9,137

$9,137

EXELON CORP COM

203,178 sh

-43,330 sh

-18%

-18%

$8,857

-$2,238

PETROLEO BRASILEIRO SA PETRO SP ADR NON VTG

765,506 sh

45,051 sh

6%

6%

$8,627

$111

BANCO BILBAO VIZCAYA ARGENTA SPONSORED ADR

347,125 sh

47,906 sh

16%

16%

$8,091

$2,331

BHP GROUP LTD SPONSORED ADS

130,841 sh

18,412 sh

16%

16%

$7,899

$1,631

HSBC HLDGS PLC SPON ADR NEW

98,649 sh

-237,097 sh

-71%

-71%

$7,761

-$16,070

BANK NEW YORK MELLON CORP COM

66,472 sh

-25,323 sh

-28%

-28%

$7,717

-$2,285

KINROSS GOLD CORP COM

248,787 sh

-56,478 sh

-19%

-19%

$7,010

-$572

WEIBO CORP SPONSORED ADR

637,145 sh

-408,656 sh

-39%

-39%

$6,512

-$6,456

EDISON INTL COM

107,189 sh

42,922 sh

67%

67%

$6,433

$2,880

M & T BK CORP COM

31,857 sh

1,936 sh

6%

6%

$6,419

$506

B2GOLD CORP COM

1,406,215 sh

1,079,831 sh

331%

331%

$6,340

$4,725

QNITY ELECTRONICS INC COM

77,507 sh

77,507 sh

NEW

NEW

$6,328

$6,328

RYANAIR HLDGS PLC SPONSORED ADS

87,398 sh

60,260 sh

222%

222%

$6,309

$4,675

Regions Financial Corp. COM

227,271 sh

159,749 sh

237%

237%

$6,159

$4,378

TRUIST FINANCIAL CORP COM

122,212 sh

46,492 sh

61%

61%

$6,014

$2,552

CONSOLIDATED EDISON INC COM

55,856 sh

1,163 sh

2%

2%

$5,548

$50

SHELL ADR EACH REP 2 ORD WI SPONSORED ADR

73,655 sh

-27,363 sh

-27%

-27%

$5,412

-$1,814

ENERFLEX LTD COM

337,900 sh

-86,000 sh

-20%

-20%

$5,216

$643

GMO ETF TRUST ULTRA-SHORT INCO

103,700 sh

103,700 sh

NEW

NEW

$5,184

$5,184

CDN IMPERIAL BK COMM TORONTO COM

56,855 sh

-64,550 sh

-53%

-53%

$5,160

-$4,543

PRECISION DRILLING CORP COM

71,200 sh

1,900 sh

3%

3%

$5,116

$1,212

TFII CN COM

49,002 sh

35,452 sh

262%

262%

$5,064

$3,871

CENTERRA GOLD INC COM COM

346,071 sh

240,780 sh

229%

229%

$4,973

$3,843

DR REDDYS LABS LTD ADR

344,233 sh

-72,000 sh

-17%

-17%

$4,833

-$986

LARGO INC COMMON STOCK

5,050,356 sh

$4,827

FOMENTO ECONOMICO MEXICANO S SPON ADR UNITS

47,538 sh

32,539 sh

217%

217%

$4,805

$3,326

SANOFI SPONSORED ADR

98,171 sh

13,007 sh

15%

15%

$4,757

$737

EQUINOR ASA SPONSORED ADR

200,125 sh

25,608 sh

15%

15%

$4,729

$474

ICL GROUP LTD COMMON STOCK

792,840 sh

255,334 sh

48%

48%

$4,552

$1,184

SLM CORPORATION COM

162,228 sh

-58,831 sh

-27%

-27%

$4,390

-$1,729

ZIM INTEGRATED SHIPPING SERV SHS

200,445 sh

-33,706 sh

-14%

-14%

$4,255

$1,082

VALE S A SPONSORED ADS

317,300 sh

317,300 sh

NEW

NEW

$4,134

$4,134

SUNCOR ENERGY INC NEW COM

92,254 sh

92,254 sh

NEW

NEW

$4,100

$4,100

360 FINANCE INC ADS

207,088 sh

194,058 sh

1489%

1489%

$3,991

$3,616

APTIV HOLDINGS LTD EQTY

52,225 sh

14,592 sh

39%

39%

$3,974

$729

SPDR S&P 500 ETF TR TR UNIT

5,530 sh

4,642 sh

523%

523%

$3,771

$3,179

HUNTINGTON BANCSHARES INC COM

185,319 sh

-1,339 sh

-1%

-1%

$3,215

-$9

Gevo Inc COM PAR

1,491,838 sh

-444,687 sh

-23%

-23%

$2,984

-$812

UGI CORP NEW COM

79,285 sh

11 sh

0%

0%

$2,968

$331

POSCO SPONSORED ADR

52,393 sh

-12,884 sh

-20%

-20%

$2,788

-$424

DUKE ENERGY HOLDING CORP COM

22,771 sh

5,935 sh

35%

35%

$2,669

$586

Annaly Capital Management Inc. COM

112,479 sh

38,360 sh

52%

52%

$2,515

$1,017

SUPER MICRO COMPUTER INC COM

83,995 sh

83,995 sh

NEW

NEW

$2,459

$2,459

ING GROEP N V SPONSORED ADR

86,660 sh

-38,455 sh

-31%

-31%

$2,426

-$837

KB FINANCIAL GROUP INC SPONSORED ADR

27,481 sh

-27,811 sh

-50%

-50%

$2,364

-$2,220

ERICSSON ADR B SEK 10

235,334 sh

75,370 sh

47%

47%

$2,271

$948

AMERICAN ELEC PWR CO INC COM

18,892 sh

8,274 sh

78%

78%

$2,178

$983

GERDAU S A SPON ADR REP PFD

586,191 sh

-55,132 sh

-9%

-9%

$2,163

$175

2023 ETF SERIES TRUST II GMO US QUALITY E

49,728 sh

49,728 sh

NEW

NEW

$1,913

$1,913

2023 ETF SERIES TRUST II GMO INTL VALUE

56,070 sh

56,070 sh

NEW

NEW

$1,883

$1,883

2023 ETF SERIES TRUST II GMO US VALUE

68,184 sh

68,184 sh

NEW

NEW

$1,874

$1,874

Tim S A Sponsored Adr Common Stock

90,415 sh

$1,759

UBS GROUP AG SHS

37,442 sh

30,699 sh

455%

455%

$1,747

$1,471

ISHARES TR 3 7 YR TREAS BD

14,302 sh

14,302 sh

NEW

NEW

$1,707

$1,707

Concentrix Corp COM

40,284 sh

-964 sh

-2%

-2%

$1,675

-$229

GOLD FIELDS LTD NEW SPONSORED ADR

36,300 sh

-28,200 sh

-44%

-44%

$1,585

-$1,121

SUZANO SA SPON ADS

165,423 sh

165,423 sh

NEW

NEW

$1,545

$1,545

CHECK POINT SOFTWARE TECH LT ORD

8,091 sh

2,468 sh

44%

44%

$1,501

$338

VANGUARD SCOTTSDALE FDS INTER TERM TREAS

25,037 sh

25,037 sh

NEW

NEW

$1,500

$1,500

SILICON MOTION TECHNOLOGY CO SPONSORED ADR

16,100 sh

$1,492

SIXTH STREET SPECIALTY LENDING COMMON STOCK

67,847 sh

1,357 sh

2%

2%

$1,474

-$46

COMPANHIA ENERGETICA DE MINA SP ADR N-V PFD

717,492 sh

$1,435

INVESCO EXCHNG TRADED FD TR NATL AMT MUNI

61,796 sh

61,796 sh

NEW

NEW

$1,433

$1,433

SHINHAN FINANCIAL GROUP CO L SPN ADR RESTRD

26,205 sh

-3,676 sh

-12%

-12%

$1,405

-$100

NEXTERA ENERGY INC COM

17,484 sh

$1,404

OWL ROCK CAPITAL CORPORATION COM

105,708 sh

862 sh

1%

1%

$1,314

-$25

BLACKROCK INC COM Stock

1,221 sh

$1,307

FIFTH THIRD BANCORP COM

27,016 sh

-18,543 sh

-41%

-41%

$1,265

-$765

BW LPG LTD COM

93,824 sh

-1,783 sh

-2%

-2%

$1,228

-$139

SOUTHERN CO COM

13,534 sh

$1,180

CRH PLC ORD COMMON STOCK

9,417 sh

-2,975 sh

-24%

-24%

$1,175

-$311

ISHARES INC CORE MSCI EMKT

17,424 sh

17,424 sh

NEW

NEW

$1,171

$1,171

EVERGY INC COM

16,075 sh

$1,165

ISHARES TR CORE MSCI INTL

13,959 sh

13,959 sh

NEW

NEW

$1,151

$1,151

SCHWAB STRATEGIC TR INTRM TRM TRES

44,874 sh

44,874 sh

NEW

NEW

$1,125

$1,125

SPDR SERIES TRUST PORTFLI INTRMDIT

39,004 sh

39,004 sh

NEW

NEW

$1,125

$1,125

FUTU HLDGS LTD SPON ADS CL A

6,657 sh

$1,093

2023 ETF SERIES TRUST II GMO INTL QUALITY

36,055 sh

36,055 sh

NEW

NEW

$959

$959

ALIBABA GROUP HLDG LTD SPONSORED ADS

5,660 sh

-102,654 sh

-95%

-95%

$830

-$18,529

IMPERIAL OIL LTD COM NEW

9,549 sh

-7,900 sh

-45%

-45%

$826

-$756

WOODSIDE PETROLEUM LTD COM

52,057 sh

15,657 sh

43%

43%

$812

$264

P T TELEKOMUNIKASI INDONESIA SPONSORED ADR

38,078 sh

-55,800 sh

-59%

-59%

$802

-$965

ECOPETROL S A SPONSORED ADS

79,400 sh

36,200 sh

84%

84%

$796

$398

COMPANHIA PARANAENSE DE ENER SPONSORED ADS

83,173 sh

83,173 sh

NEW

NEW

$791

$791

ISHARES INC MSCI EMRG CHN

10,656 sh

10,656 sh

NEW

NEW

$774

$774

ISHARES TR MSCI JP VALUE

19,314 sh

19,314 sh

NEW

NEW

$767

$767

GLOBAL FOUNDRIES INC COMMON STOCK

20,800 sh

20,800 sh

NEW

NEW

$726

$726

GLOBAL SHIP LEASE INC NEW COM CL A

20,700 sh

20,700 sh

NEW

NEW

$725

$725

GARRETT MOTION INC COM

39,085 sh

$681

GILDAN ACTIVEWEAR INC COM

10,685 sh

10,685 sh

NEW

NEW

$669

$669

Jackson Financial Inc. Common Stock

6,229 sh

3,878 sh

165%

165%

$664

$426

BARCLAYS PLC ADR

25,046 sh

-21,872 sh

-47%

-47%

$637

-$333

RENTOKIL INITIAL PLC COM

21,600 sh

-24,700 sh

-53%

-53%

$636

-$533

Altimmune Inc COM NEW

172,559 sh

172,559 sh

NEW

NEW

$623

$623

XCEL ENERGY INC MINN COM

8,385 sh

8,385 sh

NEW

NEW

$619

$619

OneMain Holdings, Inc. COM

9,108 sh

9,108 sh

NEW

NEW

$615

$615

PAGSEGURO DIGITAL LTD COM CL A

60,200 sh

-326,200 sh

-84%

-84%

$580

-$3,284

VANGUARD SCOTTSDALE FDS SHORT TERM TREAS

9,592 sh

9,592 sh

NEW

NEW

$563

$563

GLOBANT S A COM

8,148 sh

8,148 sh

NEW

NEW

$533

$533

CITIZENS FINL GROUP INC COM

8,806 sh

-4,250 sh

-33%

-33%

$514

-$180

Sharkninja Inc COM

4,577 sh

-11,090 sh

-71%

-71%

$512

-$1,104

PHINIA INC COMMON STOCK

7,774 sh

-481 sh

-6%

-6%

$487

$13

FIRSTSERVICE CORP NEW COM

3,100 sh

$483

DTE ENERGY CO COM

3,720 sh

-4,341 sh

-54%

-54%

$480

-$660

OUTFRONT Media Inc COM

19,698 sh

-6,147 sh

-24%

-24%

$475

$2

Worthington Industries Inc COM

8,864 sh

$457

IBEX Limited COM

11,538 sh

-558 sh

-5%

-5%

$441

-$49

ASSOCIATED BANC CORP COM

15,540 sh

$400

ISHARES TR EAFE SML CP ETF

4,810 sh

4,810 sh

NEW

NEW

$373

$373

NETEASE INC SPONSORED ADS

2,700 sh

-12,700 sh

-82%

-82%

$372

-$1,969

ICICI BK LTD ADR

11,293 sh

-3,581 sh

-24%

-24%

$337

-$113

FIRST FINL CORP IND COM

5,178 sh

$313

VALLEY NATL BANCORP COM

26,171 sh

26,171 sh

NEW

NEW

$306

$306

AMENTUM HOLDINGS INC COM COM

10,457 sh

$303

POPULAR INC COM NEW

2,317 sh

2,317 sh

NEW

NEW

$289

$289

PETROLEO BRASILEIRO SA PETRO SPONSORED ADR

24,048 sh

-4,737 sh

-16%

-16%

$285

-$79

PORTLAND GEN ELEC CO COM NEW

5,932 sh

5,932 sh

NEW

NEW

$285

$285

IDAHO STRATEGIC RESOURCES COM NEW

6,638 sh

6,638 sh

NEW

NEW

$268

$268

NOVA MEASURING INSTRUMENTS L COM

802 sh

802 sh

NEW

NEW

$268

$268

BANKUNITED INC COM

5,734 sh

-4,311 sh

-43%

-43%

$256

-$127

HANMI FINL CORP COM NEW

8,934 sh

-994 sh

-10%

-10%

$241

-$4

Harmony Biosciences Holdings Inc. COM

5,371 sh

5,371 sh

NEW

NEW

$201

$201

ANGI INC CL A NEW Stock

12,711 sh

12,711 sh

NEW

NEW

$164

$164

NOKIA CORP SPONSORED ADR

18,000 sh

-12,600 sh

-41%

-41%

$116

-$31

WERIDE INC SPONSORED ADS

12,500 sh

12,500 sh

NEW

NEW

$109

$109

DAKOTA GOLD CORP COM

14,249 sh

14,249 sh

NEW

NEW

$81

$81

Terrestrial Energy Inc COM

11,475 sh

11,475 sh

NEW

NEW

$70

$70

NIOCORP DEVS LTD COM NEW

10,483 sh

10,483 sh

NEW

NEW

$56

$56

WIPRO LTD SPON ADR 1 SH

13,400 sh

-15,808 sh

-54%

-54%

$38

-$39

VERONA PHARMA PLC SPONSORED ADS

0 sh

-264,115 sh

-100%

-100%

$0

-$28,184

Sandstorm Gold Ltd COM

0 sh

-2,178,227 sh

-100%

-100%

$0

-$27,271

SUNOCO LP COM UT REP LP

Put options for 0 sh

-395,100 sh

-100%

-100%

$0

-$19,759

WEST FRASER TIMBER INL &PRD COMMON

0 sh

-264,974 sh

-100%

-100%

$0

-$18,016

UNILEVER PLC SPON ADR NEW

0 sh

-297,406 sh

-100%

-100%

$0

-$17,630

VERITEX HLDGS INC COM

0 sh

-443,835 sh

-100%

-100%

$0

-$14,882

Pinnacle Financial Partners COM

0 sh

-131,456 sh

-100%

-100%

$0

-$12,329

TOTAL S A SPONSORED ADS

0 sh

-100,498 sh

-100%

-100%

$0

-$5,999

VERALTO CORP COM SHS

0 sh

-52,921 sh

-100%

-100%

$0

-$5,642

LIBERTY GLOBAL LTD COM CL A Stock

0 sh

-452,678 sh

-100%

-100%

$0

-$5,188

MR COOPER GROUP INC COM

0 sh

-18,561 sh

-100%

-100%

$0

-$3,912

SANDISK CORP Common

0 sh

-24,603 sh

-100%

-100%

$0

-$2,760

GRAFTECH INTERNATIONAL LTD COM

0 sh

-189,518 sh

-100%

-100%

$0

-$2,430

VERMILION ENERGY INC COM

0 sh

-279,901 sh

-100%

-100%

$0

-$2,189

ITAU UNIBANCO HLDG SA SPON ADR REP PFD

0 sh

-190,130 sh

-100%

-100%

$0

-$1,396

REDDIT INC COM

0 sh

-5,195 sh

-100%

-100%

$0

-$1,195

MAPLEBEAR INC COM

0 sh

-29,257 sh

-100%

-100%

$0

-$1,075

CIA Paranaense Energia-Spon ADR Depository Receipt

0 sh

-83,173 sh

-100%

-100%

$0

-$815

HOWARD HUGHES HOLDINGS INC COM Stock

0 sh

-8,000 sh

-100%

-100%

$0

-$657

INDEPENDENT BANK CORP MICH COM NEW

0 sh

-13,122 sh

-100%

-100%

$0

-$406

AMEREN CORP COM

0 sh

-3,007 sh

-100%

-100%

$0

-$314

JD.COM INC SPON ADR CL A

0 sh

-8,384 sh

-100%

-100%

$0

-$293

HDFC BANK LTD SPONSORED ADS

0 sh

-7,875 sh

-100%

-100%

$0

-$269

OLD NATL BANCORP IND COM

0 sh

-11,806 sh

-100%

-100%

$0

-$259

FIRST BANCORP P R COM NEW

0 sh

-11,347 sh

-100%

-100%

$0

-$250

Masterbrand Inc COM

0 sh

-17,938 sh

-100%

-100%

$0

-$236

FARMERS NATL BANC CORP COM

0 sh

-14,154 sh

-100%

-100%

$0

-$204

NATWEST GROUP PLC SPONS ADR ADR

0 sh

-10,388 sh

-100%

-100%

$0

-$147